About Esteema Capital & Investments Partners

Esteema Capital Partners is a London-based Multi-Family Private Office, and capital-markets, investments & transactions partners across the UK and prime global markets.

We operate through three strategic complementary expertise to allow us to act as a capital-led advisory and execution partner, bridging investors, asset owners, developers, and corporates with aligned private and institutional capital.

- Esteema ‘Capital Funding & Investment’ Partners

- Esteema ‘Strategic Estate & Asset Transaction’ Partners

- Esteema ‘Strategic Consultancy’ Partners

Our focus is on complex, non-standard, and high-value situations where disciplined underwriting, structuring expertise, governance, and execution certainty are critical.

1. Esteema ‘Capital Funding & Investment’ Partners

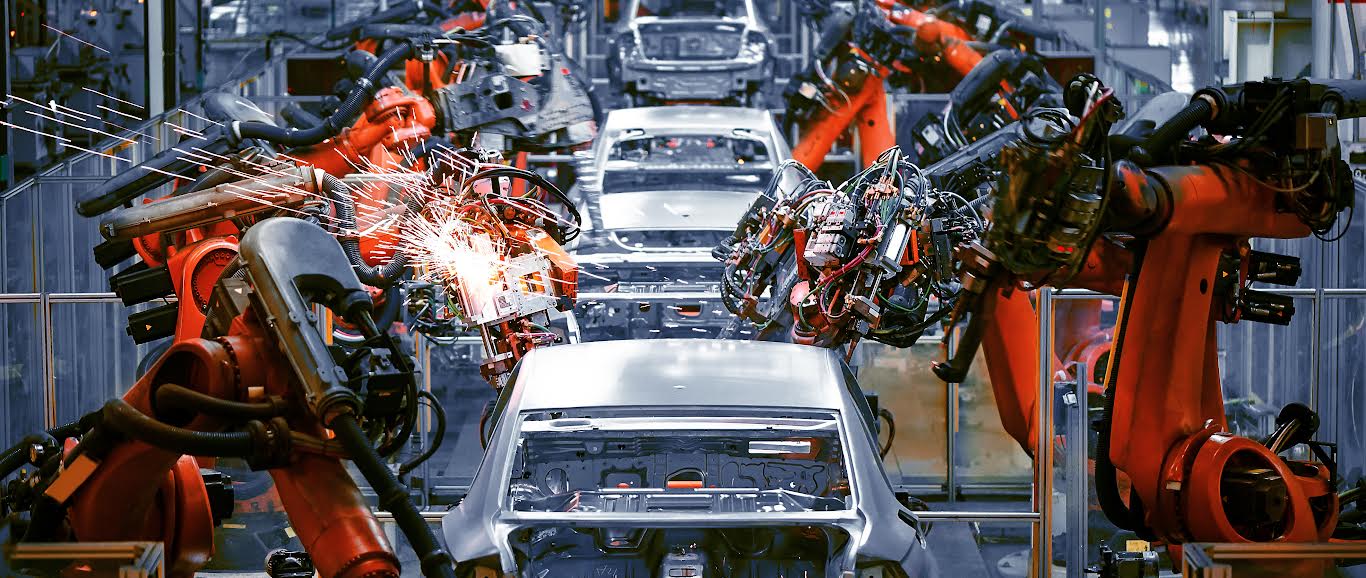

(Real Estate | Hospitality | Healthcare | Corporate | Special Situations)

Debt | Equity | Joint Venture| Any Purpose & Any Amount

Esteema Capital Partners’ Capital Markets & Investment Advisory practice provides strategic capital structuring and execution-led advisory for complex capital & investments requirement from mid-size to the large transaction. We act as a principal-minded capital partner, supporting clients where funding requirements are bespoke, multi-layered, cross-border, or time-sensitive, and where alignment between capital, structure, and execution certainty is critical.

Our role is to design capital solutions that are institutionally underwriteable, financeable, and executable, before engaging capital providers—ensuring efficiency, credibility, and certainty of outcome.

Global Capital Resources & Market Access

We provide direct access to a diversified and credible capital ecosystem, including:

- Private credit funds and alternative lenders

- Family offices and private investment platforms

- Institutional investors and real estate private equity

- Development and structured finance providers

- Club and syndicated capital sources (UK, Europe, Middle East, Asia)

Our relationships are decision-maker-led, enabling faster credit outcomes, informed pricing, and execution certainty—particularly where traditional banking solutions are constrained.

Complete Capital Stack Capability

We structure and optimise full-stack capital solutions, including:

- Senior and junior debt

- Development and investment finance

- Mezzanine and structured credit

- Preferred equity and equity

- Joint ventures and co-investment structures

- Bridge-to-term and acquisition-to-stabilisation solutions

Each structure is tailored to the asset, business plan, jurisdiction, and exit strategy—rather than forced into a generic funding template.

Institutional Underwriting at the Core

At the heart of our platform is institutional-grade underwriting, applied consistently across all mandates—regardless of size, sector, or jurisdiction.

Our underwriting framework includes:

- Asset-level and portfolio-level cash flow analysis

- Downside, base, and stabilised scenarios

- Sensitivity testing on leverage, yield, interest rates, and exit values

- Credit risk assessment and mitigation strategies

- Sponsor strength, track record, and alignment analysis

- Structure-led risk allocation between debt, equity, and JV partners

This discipline ensures every opportunity is capital-ready, de-risked, and aligned with investor and lender requirements before capital is approached.

Sector-Agnostic, Situation-Driven Advisory

Our capital advisory is not product-led. We operate across:

- Real Estate (hospitality, commercial, residential, mixed-use)

- Corporate and operating businesses

- Infrastructure and special assets

And across any purpose, including:

- Acquisition and development

- Refinancing and recapitalisation

- Restructuring and partner buy-outs

- Special situations and distress

- Cross-border SPV restructuring

We advise on UK and offshore SPV structures, aligned with tax efficiency, regulatory considerations, investor preferences, and exit planning.

More about the Esteema ‘Capital Funding & Investment’ Partners

2. Esteema Strategic ‘Estate & Asset Transactions’ Partners

Real Estate | Hospitality | Healthcare | Corporate

Acquisitions | Disposals | Asset Management

Beyond capital, we act as Strategic Estate & Asset Transaction Partners.

Esteema Strategic Estate & Asset Transactions practice advises on investments, acquisitions, disposals, and complex asset transactions across single assets and multi-asset portfolios.

We act as Strategic Estate & Asset Transactions Partners to private and institutional clients, delivering mid- to large-scale transactions with confidentiality, valuation discipline, and certainty of execution. Our advisory approach is capital-led, valuation-driven, and execution-focused.

We are engaged where assets require:

- Careful positioning to institutional capital

- Controlled and selective market exposure

- Alignment between pricing, capital availability, and execution risk

Transactions are typically off-market or selectively introduced and are never broadly marketed. We introduce the right capital to the right opportunity at the right time, protecting value, reputation, and outcomes.

Capital-Led, Execution-Driven Philosophy

Across both disciplines, our philosophy is defined by:

- Capital-led execution – transactions structured to meet real investment mandates and funding criteria

- Valuation discipline – evidence-based, risk-adjusted pricing focused on certainty of close

- Discretion & control – selective engagement and controlled information flow

- Execution certainty – direct access to decision-makers and pre-aligned counterparties

We focus on quality over volume, accepting only mandates where we can deliver measurable strategic and financial outcomes.

Counterparties & Client Relationships

We work exclusively with credible, execution-ready counterparties, including:

- UHNW individuals, family offices, and private investors with discretionary capital

- Institutional investors, funds, and strategic capital providers

- Developers and owner-operators pursuing portfolio growth or repositioning

- Private and corporate asset owners

- Banks, alternative lenders, administrators, and court-appointed officers

- Law firms and professional advisors acting under formal mandate

Our relationships are long-term and repeat-driven, built on trust, governance, and delivery rather than transaction-by-transaction intermediation.

Specialist Sectors

Our experience spans capital-intensive and execution-sensitive sectors requiring institutional discipline, including:

- Hospitality assets – single assets and portfolios, operational and development situations

- Real estate & strategic assets – residential, commercial, mixed-use, and special situations

- Healthcare assets – stabilised income, development, and operator-led structures

- Corporate & special situations – divestments, SPV-led transactions, restructurings

Geographic experience includes the UK (particularly London), Europe, the Middle East, and select international markets.

Our Commitment

Our commitment is to capital-led execution certainty.

- To sellers,

we deliver discreet, valuation-aligned disposals with credible, pre-qualified counterparties and controlled processes.

- To buyers,

we provide trusted access to serious, execution-ready opportunities originating from institutional, corporate, lender, and administrator-led situations.

- To both,

we operate within a governed, compliant framework that aligns capital, valuation, and interests to deliver certainty of close and trusted outcomes.

More about the Esteema Strategic ‘Estate & Asset Transactions’ Partners

3. Esteema ‘Strategic Consultancy’ Partners

Management-Business-Investments

Capital-Led | Growth-Focused | Profitability-Driven

Esteema Strategic Consultancy Partners delivers strategic, commercial, financial, Investments and structural advisory to private investors, businesses, financial & investments companies navigating growth, expansion, acquisitions, capital markets, and organisational transformation.

Built on extensive experience across capital markets, fund structuring, M&A, and complex asset transactions, our consultancy ensures that strategy, capital, legal structure, and execution are designed together. We advise at the board, shareholder, and senior management levels, delivering practical, capital-aware, and profitability-focused strategies that are institutionally credible and execution-ready.

Unlike traditional management consultants, our advice is not theoretical. Every strategy we develop is shaped by real-world experience across debt and equity markets, private capital, venture growth, IPO pathways, acquisitions, and asset platforms—ensuring outcomes that are bankable, investable, scalable, and exit-ready.